Our Solutions

We thoroughly evaluate your individual demands and needs to develop tailored financial solutions, always aligned with the regulatory rules and standards in each country where we operate.

We propose the best investments for your financial goals. Gain access to proprietary funds and exclusive funds from other renowned asset managers in the country.

What is a Managed

Portfolio?

A Managed Portfolio offers a specialized resource management service, focused on the careful selection of assets. Designed for qualified individuals as professional investors, this portfolio is actively managed to achieve diversification, security, and profitability.

Through the Managed Portfolio, you gain access to all the experience and knowledge of Matera RC in the field of investments. A team of professionals and managers specialized in fixed-income assets meticulously formulates and adjusts investment strategies.

Composition

Most components of the Managed Portfolio consist of products that are exempt from Income Tax. However, a small portion of non-exempt assets is designated to cover the administration fee. Thus, the portfolio is composed of:

How the Managed Portfolio Works

In addition to the specialized management service, the Managed Portfolio leverages highly regarded credit and legal analysis to carefully select the products that will be included in the portfolio.

When choosing to invest, funds are allocated through debit from a checking account or through the integration of assets, the latter being subject to prior approval from Matera RC.

Exempt Assets

CRI, CRA, LCI, LCA, Incentivized Debentures, among others.

Non-Exempt Assets

Fixed-income investment funds.

Fees and Costs

The service of the Managed Portfolio from Matera RC has a minimum initial investment value of R$ 200,000.00 and is exclusive to professional investors.

The Portfolios have an administration fee that varies between 0.30% and 1.00% on the portfolio value, with no minimum fee, depending on how much each client has invested.

In the Managed Portfolio, there is no administration fee on securities issued by Matera RC or funds managed by companies of the Group. In other words, there is no fee on fees.

Differentials

Matera RC offers active, specialized, and professional management for your investments, seeking security, solidity, and profitability. Invest in the Managed Portfolio and build a portfolio of products exempt from Income Tax and/or incentivized, benefiting from all the expertise and reputation of our Asset.

Invest with professionals with over 30 years of experience.

HOW TO GET STARTED?

The first step to get started is

to create your account.

After registering your account on the site, your information will be sent to one of our investment specialists, who will start the analysis to determine the best investment portfolio for you.

Open Your Account

Open your account and sign our contract 100% online and without any bureaucracy.

Schedule

We learn about you and your goals through our channel, then our team develops a tailor-made investment portfolio.

Portfolio Construction

The portfolio is constructed based on the initial alignment; from there, we will monitor and rebalance (if necessary) automatically.

Constant Monitoring

We monitor over 18,000 investment funds to seek opportunities for the managed portfolio.

Discover More Advantages of

the BTG Pactual Credit Card

Virtual Card

Use your virtual card for safer online shopping and also enjoy the convenience of contactless purchases through digital wallets.

Digital Wallets

Use your card to shop with Apple Pay, Google Pay, Garmin Pay, and Samsung Pay.

Intelligent Financial Management

With Finanças+, you can automatically organize your spending and cash flow and set monthly spending limits.

Additional Cards and Extra Copies

Request up to 7 additional cards for yourself or for friends and family and manage the limits and transactions directly in the app.

Annual Fee Discounts

For every R$ 1,000 spent on credit or R$ 10,000 invested in BTG Pactual*, you earn R$ 10 off your card’s monthly fee.

Points Program

Earn up to 2.2 points for every dollar spent. Choose your preferred program and redeem your points for miles, services, or benefits.

Cashback on Your Statement

Up to 1% of your purchases comes back to you every month as cashback directly on your statement, for you to use as you wish.

Automatic Debit

Register your statement for automatic debit and have your payment always scheduled.

Advantages of Trading Equity at BTG Pactual

Possibility of Higher Returns

BTG Pactual offers special leverage conditions that can enhance your results even with smaller investments.

High Liquidity Asset Alternatives

Carry out your operations easily and quickly by prioritizing more liquid assets.

Specialized Support

Get your questions answered by an expert and trade with greater confidence.

Complete Support for Day Trading

Enjoy zero commission for investing in Stocks, ETFs, Mini-index, Mini-dollar, and other assets, and use pro platforms for free, trading at least one Mini-contract per month.*

*Zero commission and free access to pro platforms are conditioned on trading at least one Mini-contract per month during the first three months. After this period, you need to trade at least ten Mini-contracts per month to maintain zero commission and free access to the platforms..

Variable Income Products

BTG Pactual offers a wide range of Variable Income products. Learn more about some types of securities available.

Zero Fees

With BTG Pactual Empresas, you pay nothing for document analysis and foreign exchange settlement services.

Document Analysis

Benefit from free document analysis and verification of the nature of the requested transactions

Foreign Exchange Settlement

Send and receive orders in foreign currency at no cost.

Why Exchange Currency with

BTG Pactual Empresas?

Advantages for the Company

Open Fund Structure

More than 25 pension funds, with constant expansion.

100% Digital Services

From contracting to employee support.

Multi-Fund Platform

Participants receive support to diversify among conservative, moderate, and sophisticated profiles.

Financial Education

Informative lectures and follow-ups for everyone in the company.

Customization

You set the benefit rules (by position, salary, age, etc.).

Specialized Consulting

Advisory services in forming the plan alongside the company’s HR.

Advantages for Employees

- Negotiable Initial Investment with No Loading Fee

- 24/7 Advisory Services, Even After Leaving the Company.

- The Same Benefits for Their Family Members.

- Financial Security Guarantee.

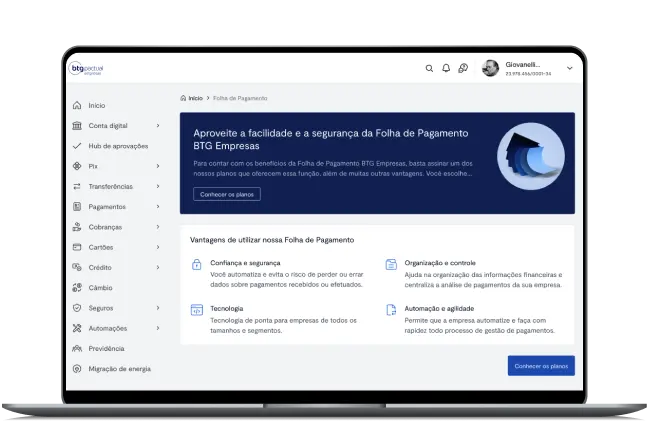

Advantages

Discover the main benefits of managing your company’s Payroll with BTG Pactual Empresas.

100% Digital Process

From opening your Business Account to your employees’ accounts, the entire process is simple, convenient, and fully online.

Zero Fees

No fees for the Business Account and payroll processing for you, and a complete fee-free account for your employees.

Online and Integrated Management

Track employee payment statuses in real time in a simple and intuitive way.

Benefits for Employees

Fee-free Checking Account and Credit Card, plus access to BTG Pactual’s product catalog and investment advisory services.

Integrated Solutions in One Place

Access to foreign exchange, investments, and various other products and services for your company on our platform.

Security of BTG Pactual

The largest Investment Bank in Latin America.

How Does It Work?

- First, open your Business Account. The process is simple, 100% digital, with no opening costs or maintenance fees.

- Once the account is open, log into the BTG Pactual Empresas platform and subscribe to the Payroll product.

- Would you like more information? Fill out the form below to get in touch with us.

Looking for a Business Account?

BTG Pactual Business Account Benefits for Your Company

Ease

100% digital account opening in just a few minutes, with ZERO account maintenance fees.

Relationship

24/7 customer support.

Availability

Available for all types of companies (such as MEI, LLC, and SA).

Security

Your data and transactions are secure with the Largest Investment Bank in Latin America.

Customization

Customizable transactional limits.

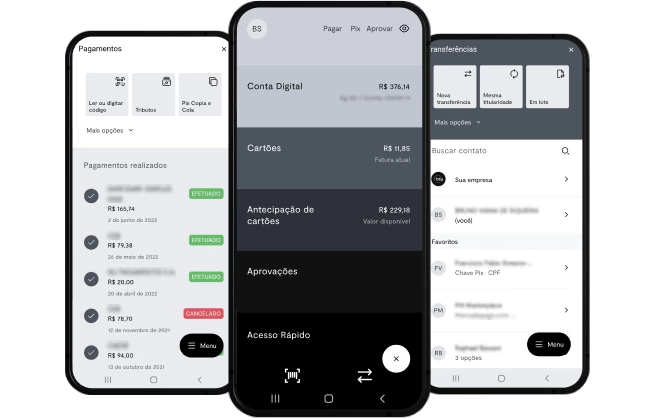

Explore the features of the BTG Pactual Business Account

- Unlimited and free PIX transfers

- Access to products and services via web and app

- Batch payments and receipts through files and API

- Advance of credit card sales

- 100% digital payroll for your company and employees

- Limite+ is the overdraft that provides an extra balance for unexpected situations

Why choose the BTG Pactual Business Credit Card?

Our credit card is specially designed to meet the needs of business owners. Learn more about it.

- Available for you

Our card* is available for all types of businesses.

*Subject to credit analysis - More efficient management

Leverage your BTG Pactual Business Card for various functions, such as supplier payments and cash flow management. - Safe and reliable

This way, you can make your purchases with peace of mind using our credit card.

Business Credit Card

The BTG Pactual Business Credit Card offers several benefits for you and your business.

Annual fee waived for the first 12 months

Contactless technology for tap-to-pay purchases

Option to split the bill* into up to 24 installments

*Subject to interest rates

Automatic debit billing enrollment

Mastercard Benefits Program, including Mastercard Surpreenda

Virtual card that can be activated before receiving the physical card

Frequently Asked Questions

How do I apply for the credit card?

Access the BTG Pactual Business app, then go to the Cards menu to apply for your credit card. During the application process, you can choose the bill’s due date and set your PIN. Credit approval is subject to analysis.

How do I activate my BTG card?

You can activate your card and set the desired limit directly in our BTG Pactual Business app. Just follow the steps:

How do I activate my virtual card?

Simply generate your virtual card through the BTG Pactual Business app, and it will be ready for use. Open the app and follow the steps:

It’s ideal for making online purchases more securely. Just copy the details displayed on the screen and enter them into the payment information section of the online store where you wish to make a purchase.

How do I enroll my bill for automatic debit?

To enroll your bill in automatic debit, follow the steps in the app:

- Menu > Card > Card Settings > Temporary Block > Automatic Debit Payment

I lost or had my card stolen, what should I do?

You can use the features of the BTG Pactual Business app in case of card loss or theft. If your card is stolen, block it directly through the app as soon as possible to prevent unauthorized use. To block your card, follow these steps:

- Rest assured: a new card will be issued for you right away.

- In the case of loss, the best option is to temporarily freeze its use until you find the card. To freeze your card through the app, follow these steps:

Menu > Card > Card Settings > Temporary Block

or

Menu > Card > PINs and Blocks > Temporary Block

Is there a maximum amount for contactless transactions?

Yes, the maximum amount for contactless payments without entering a PIN is R$ 200. For larger purchases, you can still use the contactless feature, but you will need to enter your PIN to complete the transaction.

Get to Know Life Insurance

Discover why Life Insurance is also an investment option.

Contact a specialist via WhatsApp and count on our insurance team to help you make the best choice.

Benefits

Why choose BTG Pactual’s Life Insurance?

Here are some benefits of our life insurance:

Liquidity

Unlike assets allocated in investments, Life Insurance does not enter probate, allowing for a quick release to the family.

Hassle-Free Enrollment

Skip the paperwork and document submission: you can purchase Life Insurance directly through the BTG Banking app or by speaking with your advisor.

Complete Solution

Comprehensive protection for various situations, ensuring the safety of your family and assets.

Coverages

Complete Coverage, Your Way

Choose the protections that make the most sense for you and your family. They can provide compensation or coverage of varying amounts for the following cases:

- Natural or accidental death

- Disability due to an accident

- Living compensation in case of critical illnesses, such as cancer and diabetes

- Individual funeral

- Family funeral

Meet our partners:

Functionalities and Benefits of the Account for Your Children

The Account for your children is available for kids starting at 8 years old. Check out the tools available in the Banking Account and the Investment Account to start your child’s financial journey comprehensively.

For your child:

- Pix, transfers, and payments

- Purchase of game credits

- Expense tracking with Finanças +

- Debit Card

- Investment menu available starting at 16 years old

For you:

- Access to the account to view transaction history

- Real-time push notifications

- Setting transaction limits

- Investment Account management

- Registering recurring Pix as an allowance

Debit Card

More convenience for purchases and withdrawals without additional cost. Learn about the benefits.

No monthly fee for the card

Contactless payments

Payment with digital wallets*

Mastercard Surpreenda rewards program

Withdrawals at all Banco24Horas ATMs

Prepare the future of your loved ones closely

Financial education is crucial at every stage of life. With that in mind, BTG Pactual created a solution that allows you to monitor each step of your child as they learn to invest and manage money, overseeing all transactions.

You have exclusive control over your child’s Investment Account until they turn 16. At that time, you can request that the minor gain full access to the account and manage their investments independently.

Frequently Asked Questions

How can my child access the account?

Your child can access the account using the BTG Banking app. Once the account is open, you will be notified and will be able to make transactions. At this point, the minor can download the app. On the first login, they will need to create a password and register their biometrics. After that, the account will be ready for your child to use.

How can I monitor my child’s account?

Through the BTG Banking app, you will have access to the minor’s account to view transaction history and set transaction limits. Additionally, you will receive real-time push notifications.

The Investment menu will remain hidden for the minor and can only be enabled when they turn 16. Until then, control of your child’s Investment Account will be exclusively yours and can be managed through the BTG Banking and BTG Investments apps.

Can I choose my child’s advisor?

Yes! If you already have a preferred advisor, you can select the same professional to manage your child’s account.

From what age can I open an account for my child?

The Account for your children is available for kids starting at eight years old. If you wish to open only an Investment Account, there is no minimum age requirement.