Benefits of the BTG

Pactual Debit Card

The BTG Pactual Debit Card is available to all clients with a Current Account at the Bank. Request yours directly in the BTG Banking app.

All your financial life at your fingertips

Discover some advantages that the BTG Current Account offers to help you manage your financial life.

Free Account

Open your Current Account through the BTG Banking app with no opening or maintenance fees.

Pix

Use Pix for instant transfers and payments.

Unlimited TEDs

Make free and unlimited TED transfers whenever you need.

Frequently Asked Questions

How do I request my Debit Card?

To request your card, just download the BTG Banking app, open a free account, and access the “Cards” menu.

Why can I only have the Debit Card and not the Credit Card?

When you open an account with us, we conduct some analyses to determine if you are eligible for a card with credit and debit functions or just debit. We are always analyzing the behavior and profile of our clients. Therefore, if you have only been approved to use the debit card, it’s important to continue using the current account and BTG benefits so we can better understand your habits and offer the best solutions.

When can I request a new credit analysis?

We are constantly conducting new evaluations, which means that your analysis may change over time. Thus, you can request a new analysis three months after your last attempt.

Is there a maximum value for contactless transactions?

Yes, the maximum amount for contactless transactions using your physical card on the terminal without entering a PIN is R$ 200. If it exceeds this amount, a PIN is required. For payments using digital wallets, there is no maximum amount.

International Banking Account

The International Banking Account is a checking account in dollars designed for you to go even further with your bank. BTG Pactual offers a comprehensive transactional platform abroad, ideal for making payments, transfers, and other operations.

Secure account with no fees

The BTG checking account is exempt from opening and maintenance fees, allowing you to enjoy a centralized financial life without worry: here, your assets will be secure.

Comprehensive Payment Management

With automatic debit, you eliminate the worry of your utility bills. In addition, the DDA feature manages all invoices issued under your CPF.

Shared Account

Allow trusted individuals to access your BTG account and perform functions such as transfers and payments easily and securely, directly through the app.

Integration with the Investment Account

Centralize your financial life in one place and ensure greater control and organization for your investments and daily transactions.

Salary Portability

Bring your salary to BTG Pactual and enjoy exclusive benefits for your account and credit card.

Your Card, Your Way

Customize your BTG Pactual Credit Card with the best benefits for you to enjoy in your daily life.

Benefits Modules

Customize your Card with the best advantages for travel, investments, security, entertainment, and transactions.

Loyalty Program

Receive cashback of up to 1% on your Card bill or up to 2.2 points in Esfera or Livelo for every dollar spent.

Limit by Investments

Invest in selected products and increase your limit on the BTG Pactual Credit Card.

Advantages Abroad

With the Travel Module, you have a Special IOF with 3.28% cashback, plus 4 complimentary accesses to LoungeKey VIP Lounges*.

*LoungeKey is valid only for the BTG Pactual Black Card.

Frequently Asked Questions

What is a checking account?

A checking account is a service offered by various banking institutions that allows customers to manage their daily finances and perform transactions such as Pix, bill payments, transfers, deposits, withdrawals, receiving salaries, and much more.

How to open a BTG Pactual Checking Account?

To get started, download the BTG Banking app. Then, click on “Let’s get started” and fill in your personal details and access information. Next, register your facial biometrics. After that, enter your address and your professional, financial, and foreign connection details, if applicable. Finally, complete the registration and wait for your account opening request to be approved. The analysis will be completed within three days.

Once approved, log into the app with your CPF and password, sign the bank registration form, and choose your card. Once that’s done, you can start using your Checking Account.

Can I open my BTG Pactual Checking Account on my mobile phone?

Yes! Just download the BTG Banking app and follow the step-by-step process to open an account.

How long does it take for my BTG Pactual Checking Account to be approved?

After submitting the account opening request and sending all the necessary documents, the analysis result will be released within three days.

Is a checking account the same as a bank account?

There are several types of bank accounts, and the checking account is one of them. However, there are also other types, such as savings accounts and salary accounts, for example.

I want to receive my salary in my BTG Pactual Checking Account. How do I do that?

To receive your salary in your BTG Pactual Checking Account, simply follow these steps: in the BTG Banking app, open the menu and tap on “Account.” Then, tap on “Salary Portability” and next on “Bring Salary.” Click on “Let’s Get Started” and enter the CNPJ and name of the company you work for. After that, select your employer’s payroll bank and tap on “Confirm.” Within 10 days, the payroll bank should approve your request.

What are the differentials of the BTG Pactual Checking Account?

With the BTG Pactual Checking Account, you can enjoy the convenience of concentrating all your financial life in one bank. Your investments, transactions, payments, and salary can be managed through the same account, and your security is guaranteed by the largest investment bank in Latin America.

Can anyone open a BTG Pactual Checking Account?

Anyone over 18 years old with a regular CPF can download the BTG Banking app and request to open a BTG Pactual Checking Account to enjoy the available features. Account approval is subject to analysis.

For minors, we offer the account for their children.

Is there any cost to use the Checking Account?

No opening or maintenance fees are charged for the BTG Pactual account, and you can make up to 8 free withdrawals per month. Transfers, Pix, payments, or scheduled transactions are free and unlimited.

Only a few specific features incur charges, such as additional withdrawals, cash withdrawals on credit, and international purchases, as well as interest-related fees on credit, installment payments, and overdue invoices.

How can I access my income report?

To access your income report, simply open the BTG Banking app, tap on the initials of your name in the upper left corner, select “Documents,” then “Income report,” and click “Download Report [year].”

How do I cancel my BTG Pactual Checking Account?

To close your BTG Pactual Checking Account, simply click on the profile icon on the home screen of the BTG Banking app, tap “Close your account,” click “Close your account” again, provide the reason for closure, and tap “Close your account.”

To close your BTG Pactual Checking Account, you must not have a balance other than R$ 0, an active account limit, contracted credit, or an active credit card linked to any company. Upon closing the account, all data will be deleted, including your transaction history.

PRODUCTS

Advantages of Investing in Structured Products

See how structured products can help you enhance your results.

Access to Multiple Asset Classes

Possibility of gaining exposure to various markets in a simple way.

Flexibility for Structures

Customized products for different market scenarios.

Strategies for Different Objectives

Whether for investment or protection.

Attractive Rates

For you to achieve even more significant results.

Structured Products

Different structures for different strategies.

Risks that may be associated with structured products

In the financial market, risk can be good news. This is because there is an inverse relationship between risk and return. In investments, the higher the risk, the greater the return. It all depends on the investor’s profile and their risk appetite.

Market Risk

Market risk is related to the fluctuations that the market can experience, which may result in financial losses in cases of fluctuations that go against the investor’s position.

Credit Risk

Credit risk involves the possibility that an organization or institution may not fulfill its payment obligations to investors.

Currency Risk

Also known as currency risk, it is the risk of the investor losing money due to exchange rate fluctuations when purchasing assets that involve foreign currencies.

Liquidity Risk

This is one of the most discussed concepts when it comes to investments and involves the ease with which a financial asset can be converted into cash. The faster this conversion, the higher the liquidity of the investment.

Interest Rate Risk

It is the risk of interest rate fluctuations that can impact a single asset or an entire portfolio that is linked to the rate that has changed.

Solutions in Derivatives

Learn more about the products that can make up the strategy of a structured product.

Stocks

Stocks are a small part of a company. They are a way to profit from the growth of publicly listed institutions.

ETFs

Funds that aim to replicate the portfolio of a benchmark index in the market.

BDRs

Assets listed on exchanges outside of Brazil without needing to open an account abroad.

Indices

With futures contracts for indices, such as Ibovespa and S&P, you trade the future expectations of the asset.

Interest

Profit from fluctuations in interest rates.

Currencies

A way to profit from the appreciation or depreciation of foreign currencies.

Commodities

Se precisar de mais ajuda, é só avisar!

Energy

Maximize your results in the Free Energy Market.

What is Private Pension?

Private Pension is the ideal investment to help you build a secure future, but be aware that it goes far beyond just retirement. This type of investment offers various benefits and allows you to build your wealth with greater flexibility and diversification, focusing on the medium and long term.

Benefits of Investing in Private Pension

Retirement Supplement

Ensure a secure future without relying solely on Social Security for a comfortable retirement.

Tax Benefit

You can deduct up to 12% of your annual taxable gross income on your income tax return through contributions to PGBL plans.

Flexibility and Diversification

Switch funds according to the needs of your portfolio without needing to withdraw the invested amount and invest in a new plan.

Wealth Succession

Plan for the future of your children and heirs in a simple and efficient way.

Absence of “Come-cotas”

Achieve more attractive returns than those of investments subject to this taxation, as the money that would be collected continues to earn.

Diversification of the Investment Portfolio

An advisor from BTG Pactual helps you create a diversified pension portfolio according to your investor profile.

What are the types of Private Pension plans?

There are two types of Private Pension plans: PGBL and VGBL. Discover which one makes more sense for you.

Free Benefit Generating Plan (PGBL)

More suitable for those who file a complete income tax return and contribute to the INSS. It allows the deduction of the contribution amounts up to a limit of 12% of the annual taxable gross income. The income tax is applied to the total amount to be withdrawn (contributions and earnings).

- More suitable for those who file a complete income tax return and contribute to the INSS or the Own Social Security System.

- Tax benefit on Income Tax

Benefit Generating Life Plan (VGBL)

Recommended for those who file a simplified income tax return or are exempt. It is also an option for those who file a complete return and wish to invest more than 12% of their annual taxable gross income in Private Pension, serving as a supplement for those investing in PGBL who would like to contribute an amount beyond what is covered by the tax benefit. The income tax is applied only to the earnings.

- Ideal for simplified income tax

- Income tax only on earnings

How do taxes work in Private Pension?

The taxation of Private Pension can be progressive or regressive. Each option is more suitable for different goals and investor profiles.

Progressive Taxation

More suitable for short-term investments. The rates will be calculated based on the amount to be withdrawn, considering the income tax calculation base (see table below), with 15% withheld at source as a prepayment of the tax, and the adjustment must be made in the annual income tax return.

- Short Term

- Rates will be calculated based on the amount to be withdrawn.

Regressive Taxation

The income tax rates vary depending on the investment period, which is why it is ideal for those who can keep their funds invested for the long term.

- Long Term

Investment Funds

With our selection of funds, you can invest diversely and

increase your chances of long-term returns.

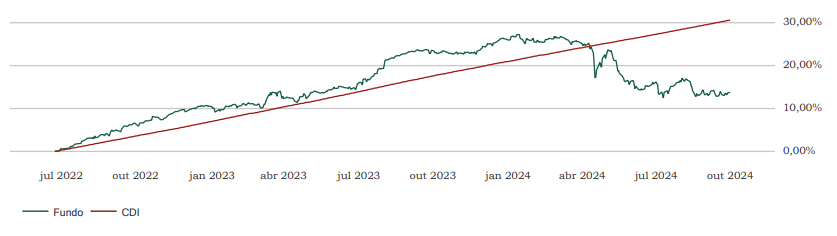

Matera RC FIM

This fund, created in 2022, was born from the merger between RC Gestão de Recursos LTDA and Venice Partnership (forming Matera RC Gestão de Recursos) to be the flagship of the partnership.

Following the same resource allocation strategy as the R&C Hedge Fim and R&C Plus Fim funds but with lower volatility and risk, the fund aims to serve investors with a greater aversion to risk who seek consistent long-term gains.

Target Audience: The fund’s target audience includes general investors looking for returns superior to the CDI over the long term.

30 set 2024

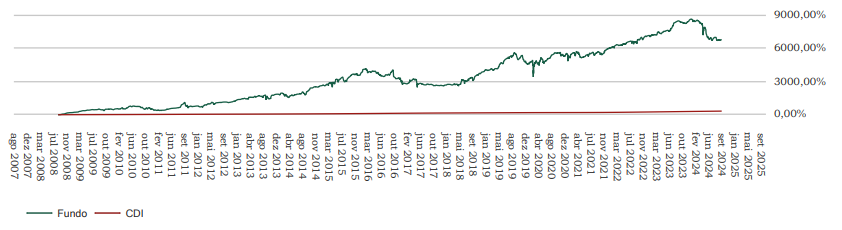

R&C HEDGE FIM

The fund was created in September 2008 by Cláudio Coppola Di Todaro and became managed by RC Gestão de Recursos Ltda. after January 2010. Its operations are focused on the futures market, seeking opportunities in higher liquidity assets within its risk profile.

The fund combines asset classes (stocks, indices, interest rates, and currencies) with the objective of delivering returns above the CDI. The investment strategy is similar to that of the R&C FIM fund but with lower exposure and volatility.

Target Audience: The fund’s target audience includes general investors looking for returns superior to the CDI over the long term.

30 set 2024

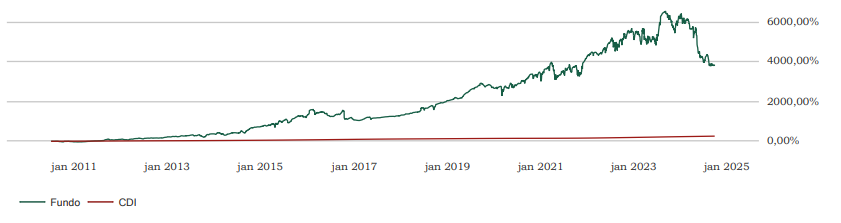

R&C PLUS FIM

The investment policy of the FUND consists of allocating its resources across various classes of financial assets and operational modalities, including variable income assets and securities, with the goal of achieving performance superior to the variation of the Interbank Deposit Rate (DI).

Target Audience: The fund is aimed at general investors seeking returns that exceed the CDI over the long term.

30 set 2024

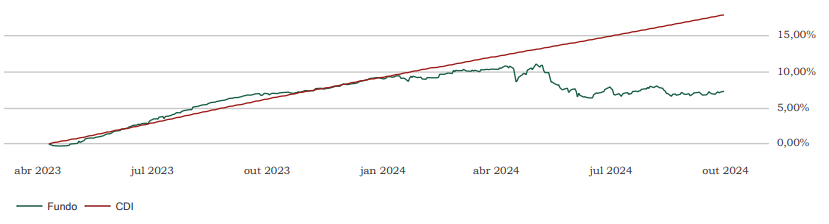

R&C HEDGE FIM

The fund combines asset classes (stocks, indices, interest rates, and currencies) in search of opportunities in more liquid assets. The investment strategy is similar to that of the Multi-Strategy funds managed by the firm, but with lower exposure and volatility.

Target Audience: General investors.

30 set 2024

More than 30 years of experience by

its directors in the financial market

We are the current manager of the R&C FIM, R&C Hedge FIM, R&C Plus FIM, Matera RC FIM, and Matera RC Previdência FIM funds. Founded in the second half of 2008, we received authorization from the Brazilian Securities and Exchange Commission (CVM) in July 2009 and began managing the funds in January 2010. Matera RC Gestão de Recursos is a manager regulated by the CVM and adheres to the ANBIMA code of best practices.

Fixed Income

Different bonds and terms for those seeking safety and predictability.

Types of Fixed Income

CDB

Bank Deposit

Certificate

A private bond issued by financial institutions with a defined term and rate at the time of purchase. This bond is covered by the Credit Guarantee Fund for up to R$ 250,000 per issuer and per CPF.

LCA

Agribusiness

Credit Letter

A private bond issued by financial institutions with a defined term and rate at the time of purchase, backed by credit operations in the agricultural sector. It is exempt from income tax (IR) and the Financial Operations Tax (IOF) for individuals, and is covered by the Credit Guarantee Fund for up to R$ 250,000 per issuer and per CPF.

LCI

Real Estate

Credit Letter

A private bond issued by financial institutions with a defined term and rate at the time of purchase, backed by credit operations in the real estate sector. It is exempt from income tax (IR) and is covered by the Credit Guarantee Fund for up to R$ 250,000 per issuer and per CPF.

CRI e CRA

Real Estate Receivables Certificate

Agribusiness Receivables Certificate

A title that generates a credit right for the investor, with a defined term and rate at the time of purchase, but with the possibility of selling in the secondary market before maturity, backed by real estate credits (CRI) or agribusiness credits (CRA). Its yield is exempt from income tax and is typically post-fixed, linked to the CDI (Interbank Deposit Certificate).

Debêntures

Incentivized Debenture

A private credit instrument issued by companies seeking financing for their financial commitments. These securities can also be traded in the secondary market and are not subject to income tax on their earnings. Investing in a debenture is, in practice, lending money to a company with a specified term to receive your money back.

Learn About Our Services

BTG Pactual offers a wide portfolio of Currency Exchange services. Learn about each of them.

Advantages of Currency Exchange Operations at BTG Pactual

At BTG Pactual, you have a solid institution at your disposal, along with excellent services and support.

*Valid for transfers of up to 3,000 dollars or 2,600 euros.

Online transfer of funds to accounts with the same ownership.

Agility in structuring, analyzing operations, processing, and payments.

Security of the largest Investment Bank in Latin America.

Sign contracts directly in the app, with one click and no bureaucracy.

Reduced costs.

Documents available for online consultation via website or app.